Full 1

Full 1

About us

About

Kerala Motor Transport Workers Welfare Fund Board

In 1985, the Government of Kerala promulgated the Kerala Motor Workers’ Welfare Fund Act to provide for the constitution of a Fund to promote the welfare of private motor transport workers in the State.

It came into force on 27.06.1985. The Kerala Motor Transport Workers Welfare Fund Scheme framed under the above Act came into force on 11.07.1985 vide G.O. (Rt.) No. 1036/85/LBR dated 29.06.1985. The Act covers all the motor transport undertakings except those covered...

Latest News

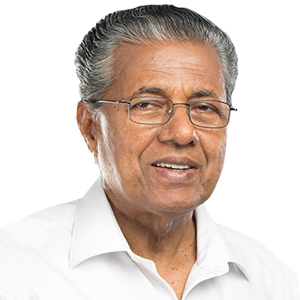

Shri Pinarayi Vijayan

Hon'ble Chief Minister

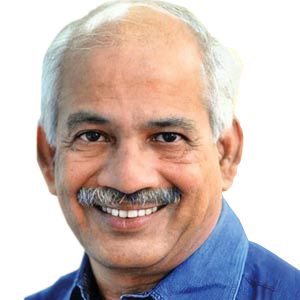

Shri V Sivankutty

Hon'ble Minister for Labour

Shri K K Divakaran

Chairman

Shri Ranjith P Manohar

CEO